🔥 Get Exlcusive Insider Information & Credit Tips from Our Members Group :

🔥 This offer expires in:

Struggling With Your Debt-to-Income Ratio?

Repair Your Credit & 'How To' Course For Advanced Disputes

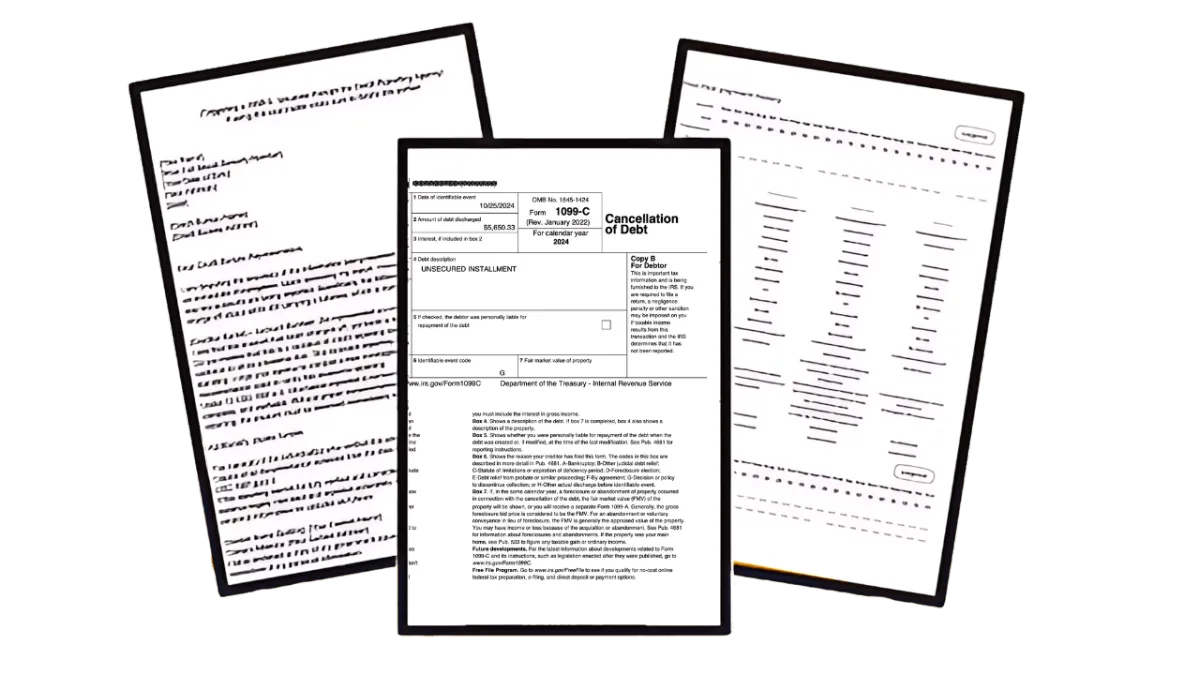

After servicing countless clients, we've perfected a strategy to help you trigger a 1099C—a game-changing move for improving interest rates, approvals, and lower down payments on the financial decisions that matter most. When a 1099C is issued, what was once debt can now be classified as income. This shift transforms your debt-to-income ratio, making it easier to qualify for loans, credit lines, and major purchases.

5 / 5 based on 88 reviews

JOE NORRIS

TEACHER & DAD OF 3

HCC is a HIGHLY reputable credit repair company. They take the time to break down everything that needs to be as it pertains to your credit profile. I highly recommend their services !!!!! Shanique is such a easy going person to speak to & i will continue to use their services !!!

MORE THAN JUST A 'MINI COURSE'

This is Your Financial Superpower

Right after your purchase, you’ll get immediate access to everything you need to legally restructure your financial profile and put yourself in a better position for approvals, lower interest rates, and financial freedom.

1099C Charge Off Triggers

Here's the content:

Part 1: How Debt-to-Income Ratio Impacts Your Financial Future

Part 2: Why Your Old Debt Might Still Be Hurting You—Even If You’re Paying It Off

Part 3: The Legal Loopholes Lenders Don’t Want You to Know About

1099C Charge Off Triggers

Here's the content:

Part 1: How Debt-to-Income Ratio Impacts Your Financial Future

Part 2: Why Your Old Debt Might Still Be Hurting You—Even If You’re Paying It Off

Part 3: The Legal Loopholes Lenders Don’t Want You to Know About

1099C Charge Off Triggers

Here's the content:

Part 1: How Debt-to-Income Ratio Impacts Your Financial Future

Part 2: Why Your Old Debt Might Still Be Hurting You—Even If You’re Paying It Off

Part 3: The Legal Loopholes Lenders Don’t Want You to Know About

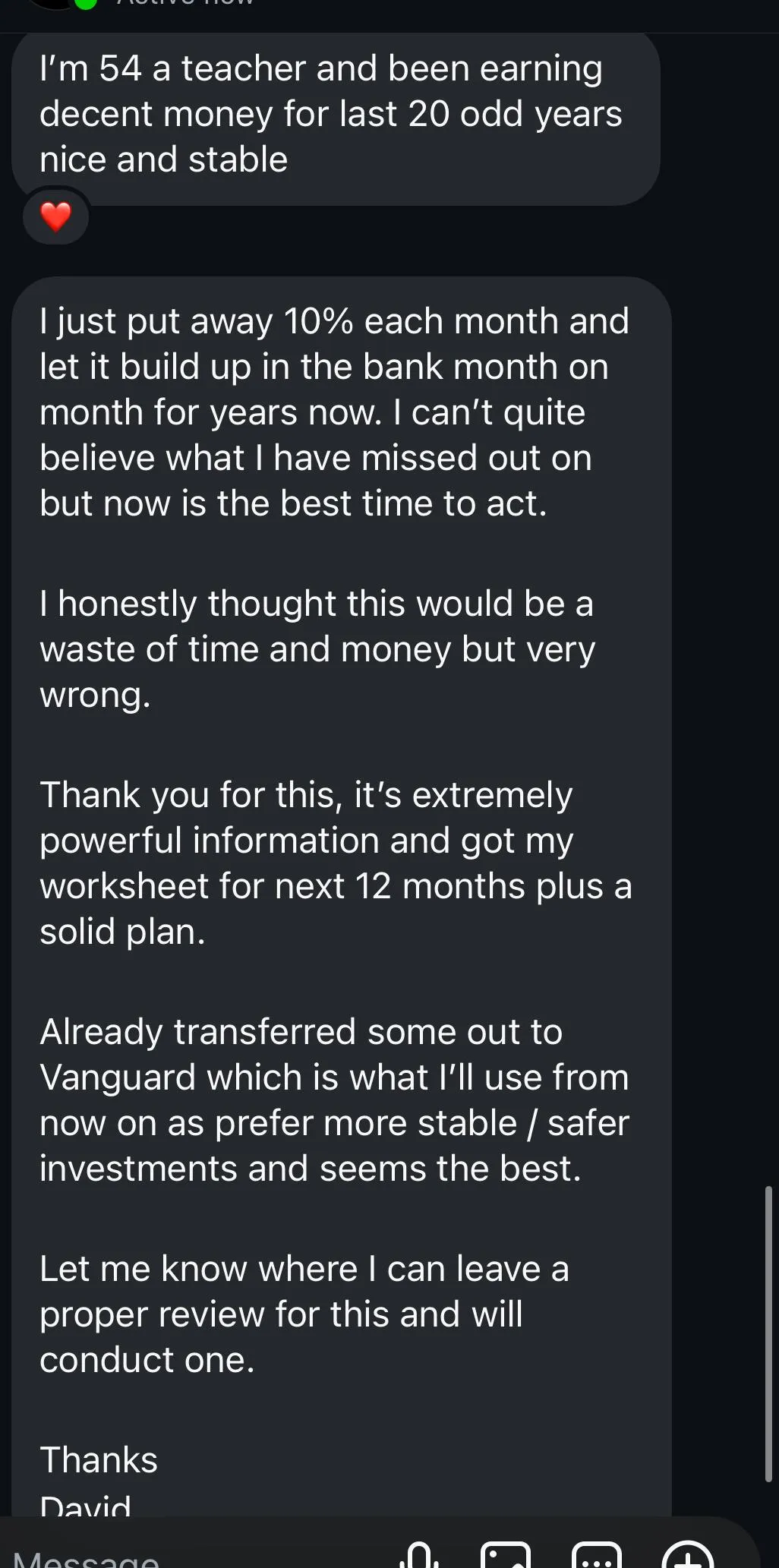

28 Reasons Why Keeping Money in the Bank Is Losing You Money...

Here's the content:

Part 1: Inflation Outpaces Bank Interest Rates

Part 2: Bank Fees and Hidden Charges

Part 3: Alternative Investments That Offer Higher Returns

The Financial Freedom Formula...

Here's the content:

Intro: How the Wealthy Build Wealth

Part 1: Diversifying Investments for Stability and Growth

Part 2: Passive Income Through Real Estate and Dividends

Part 3: Exploring Cryptocurrency and Decentralized Finance (DeFi)

Transform Your Wealth Within 12 Months

Here's the content:

Intro: Your Roadmap to Financial Freedom

Month 1-2: Financial Audit and Goal Setting

Month 3-4: Building Your Emergency Fund

Month 5-6: Educating Yourself on Investment Options

Month 6-12: Growing Your Portfolio

Resources, Tools, and Next Steps for Sustainable Wealth Growth...

Here's the content:

Intro: Resources to Help You Continue Building Wealth Independently

Part 1: Recommended Books and Courses

Part 2: Top Financial Tools and Apps for Investment Management

Part 3: Expert Tips for Wealth-Building in Volatile Markets

Taking Control of Your Financial Future...

Here's the content:

Part 1: Reflection on Financial Independence

Part 2: Embracing Long-Term Wealth-Building

Part 3: Call to Action for Continued Learning and Growth

BREAK FREE FROM THE CREDIT TRAP: GET OUR $1,587 VALUE 1099C Charge Off Triggers FOR JUST $19.99!

4.8 / 5 based on 1,931 reviews

INTRODUCING THE PROVEN STRATEGY

79% of Borrowers Struggle With Debt-to-Income Ratios & High Interest Rates – Take Control Today.

Is Your Financial Profile Working for You—Or Against You?

Every year, thousands of people face financial roadblocks simply because of how lenders calculate their debt-to-income ratio. You might be paying off old debts, but they’re still weighing you down—hurting your creditworthiness, increasing your interest rates, and limiting your approvals.

But what if there was a legal way to shift your financial profile in your favor?

Remove the Burden of Past Debt

Debt is more than just a number—it impacts your ability to get approved for loans, credit, and even mortgages. The Advanced 1099C Method helps you trigger a 1099C, which can legally change how your debt-to-income ratio is viewed.

Gain Financial Leverage

Wealthy individuals and financial institutions know how to work the system—now, you can too. This method is designed to help you shift your financial standing legally and strategically to put yourself in a better position for approvals and lower rates.

Stop Letting Banks & Creditors Control Your Profile

Lenders use your debt-to-income ratio against you, keeping you locked into higher interest rates and less favorable terms. With this strategy, you’ll learn how to legally restructure your profile to work in your favor.

Apply in Just Minutes

with Proven Templates

This isn’t guesswork—we’ve done the hard part for you. With ready-to-use letters, video guidance, and clear next steps, you can start applying these strategies in just minutes. No legal background or financial expertise required.

Plug & Play

Resources & Templates

Along with the Advanced 1099C Method, you’ll get powerful Plug & Play

Resources & Templates designed to help you maximize your financial reset. These extras will simplify the process, accelerate your results, and give you even more financial leverage.

#1: The Ultimate 1099C Letter Pack

✅ Pre-written, customizable letters designed to

maximize approval success

✅ Includes furnisher letters, agency templates, and follow-ups for best results

#2: The 1099C Legal Strategy Guide

✅ A deep dive into the laws that protect you and how to use them effectively

✅ Easy-to-understand breakdowns so you can confidently apply these methods

#3: Exclusive 1099C Tracking Spreadsheet

✅ Keep track of your progress, submissions, and responses in one simple place

✅ Stay organized and on top of your financial transformation

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

Verified Review

Charnese Alexander

Small Business Owner

" I have had an amazing experience with High Class Consulting! My credit score has gone up over 60 points in one month!!! I would definitely recommend their services to anyone who is trying to repair their credit!!! "

Verified Review

Ciara Chambers

Engineer & Investor

" Let me be the 1st to say I am always skeptical of a company that has too many great reviews, so I followed their Instagram page for awhile to see if it was worth the hype and I must say I am very happy with my results this far. The reviews are true Niq and her team are awesome!! They take the time to answer all zillion of my questions. I never have to wait for a response and well the results speak for themselves!! "

Verified Review

Erica Scott

Freelancer & mom of 2

" I really enjoyed my consult. Shaniquea was polite, informative, and made sure you understood what was going on. I would recommend the services to anyone looking to take control of their credit. I am looking forward to starting with them to repair my credit. "

Verified Review

ROBERT MARTIN

Self-employed entrepreneur

" Shaniqua is very professional, honest and knowledgeable. She answered all my questions and did not make feel like I did anything wrong and mostly she was upfront about her services and was friendly and did not give false hope about any questions asked. I will be work with her."

Verified Review

Zy’Aire Kyng

College student & part-time worker

" Shanique, your services have yielded impressive results. Within a mere five days of signing up, my credit score has increased by 49 points. Additionally, the first round of disputes has led to significant credit repairs. I am grateful for the knowledge you share about your methods and your dedication to ensuring clients maintain a healthy credit profile. "

Verified Review

MICHAEL GONZALEZ

Marketing professional

" What impressed me the most about High Class Consulting LLC is their personalized approach. They tailored a plan specifically for my needs and kept me updated every step of the way. Their customer service is outstanding. I always feel valued and heard. If your looking for a reliable and effective credit repair service, I highly recommend High Class Consulting LLC. They truly changed my financial future for the better ! "

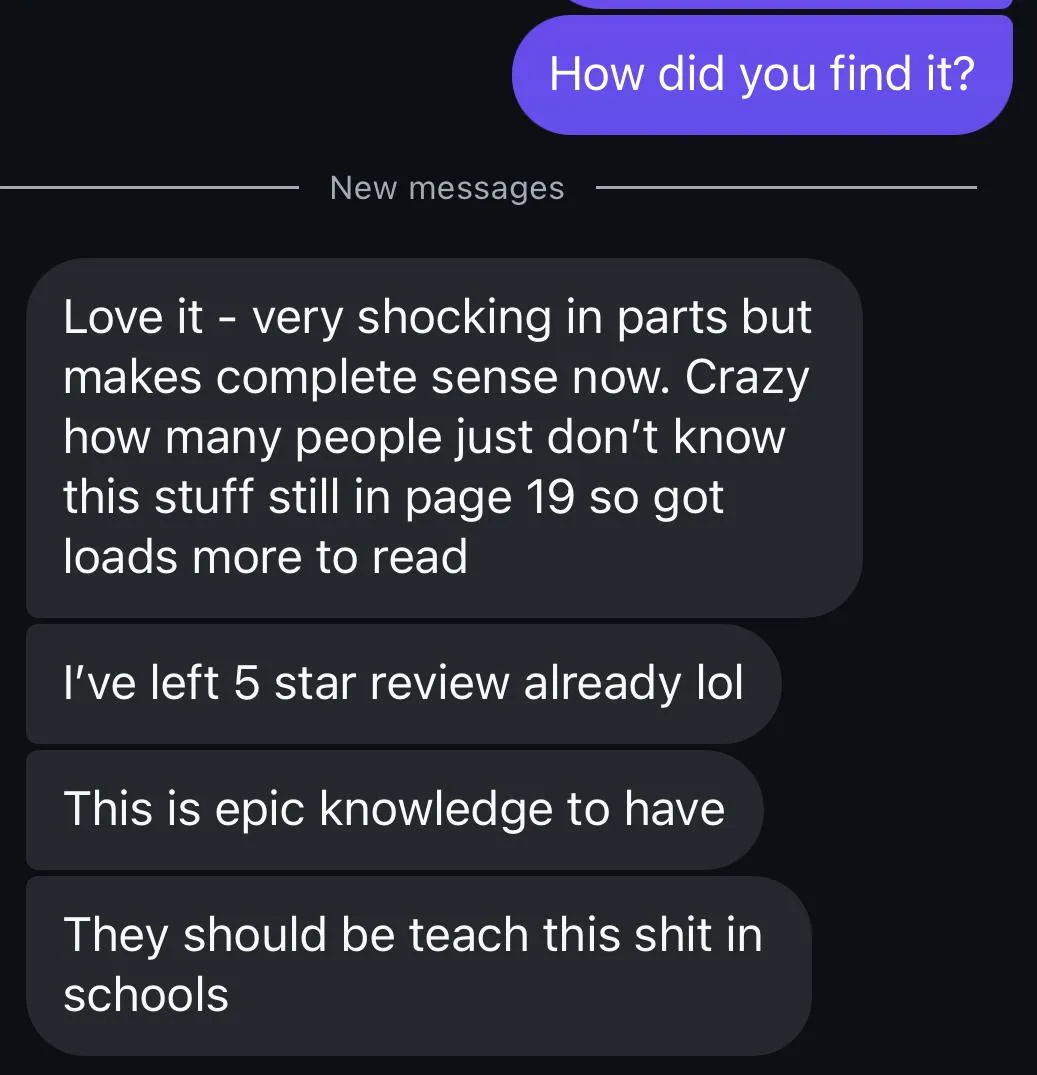

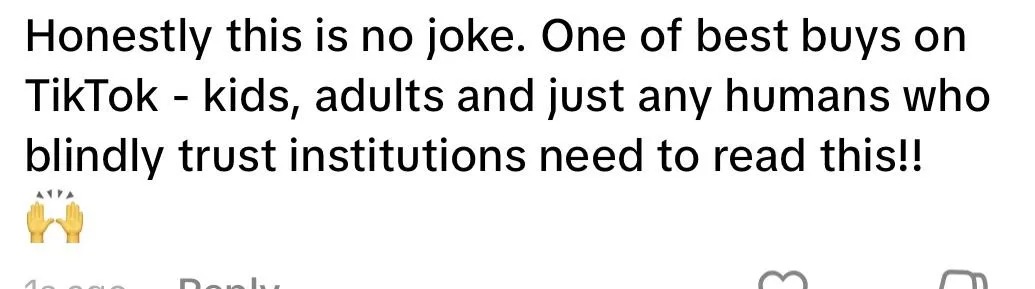

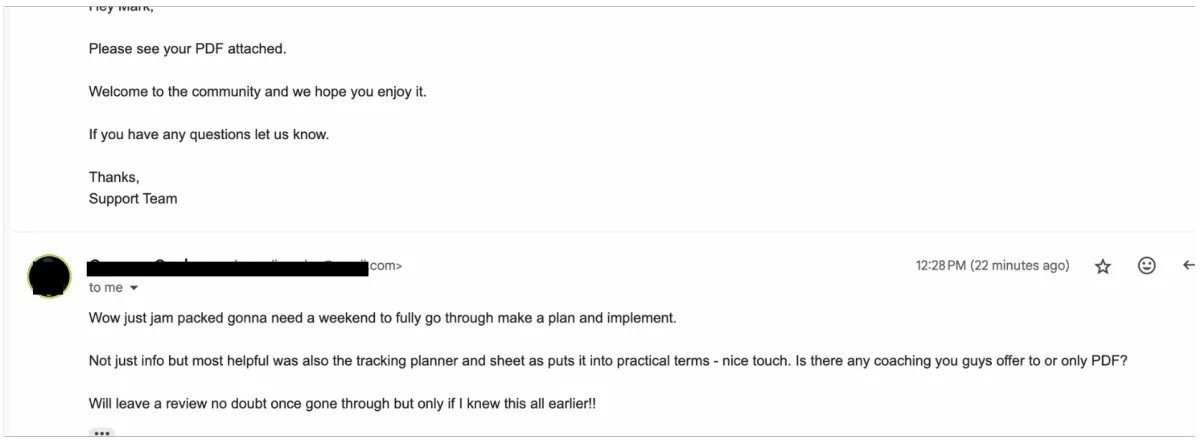

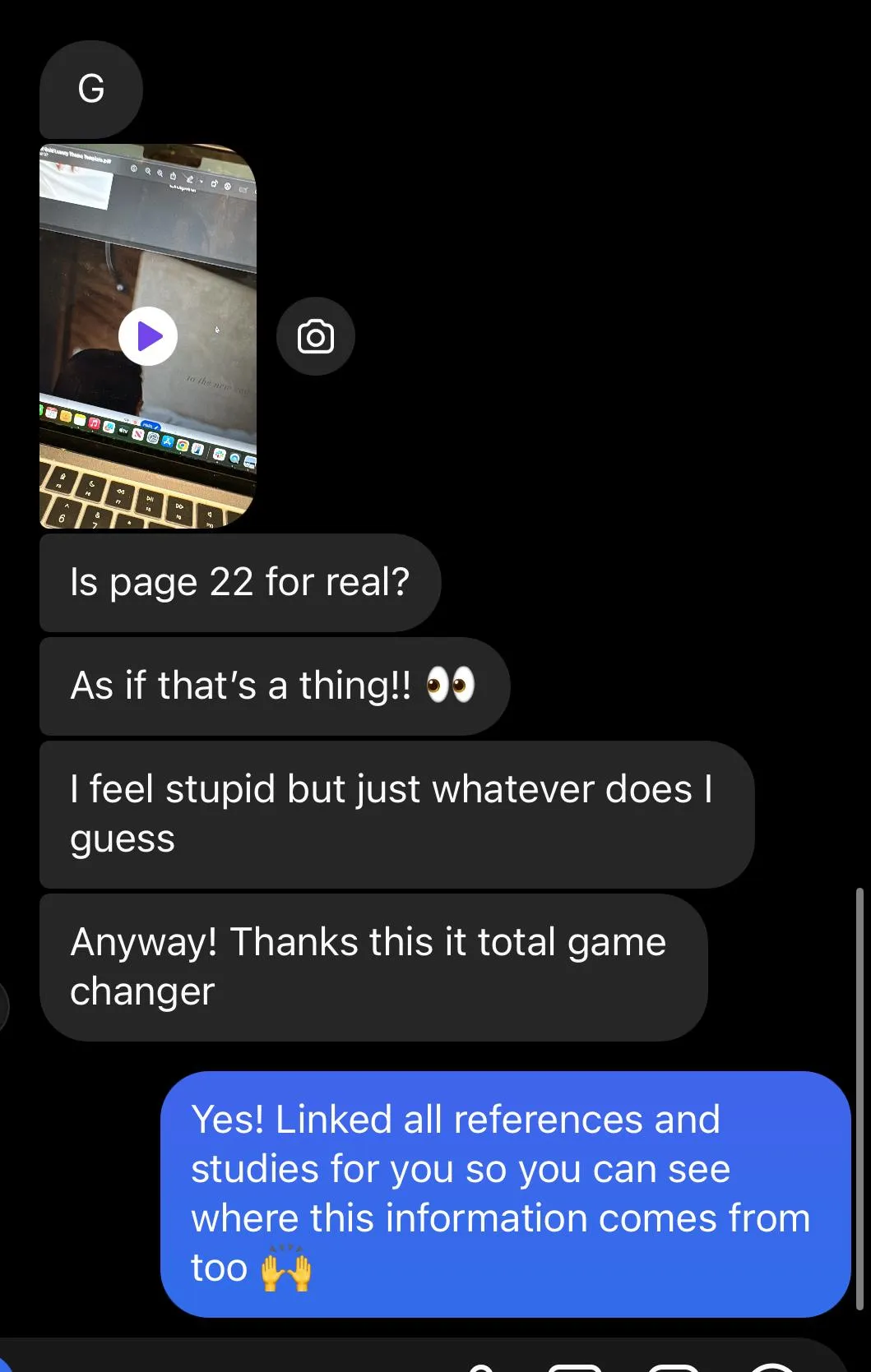

Want More? People Just Like You Send Us In This Everyday...

4.8 / 5 based on 1,931 reviews

READY TO GET STARTED?

Get The Proven Strategy to Trigger 1099c Charge Off Letters Today!

With the bundle, you gain immediate access to invaluable resources on how to beat the banks and take control of your financial future. For a limited time, grab this comprehensive package at an unbeatable price. Don’t miss this chance to transform your future and join the top 1%.

1099C Mini Course

$19.99 USD

VAT/Tax Included

4.8 / 5 based on 1,931 reviews

What's Included

Letter to furnisher

Agency Letters

Next Steps once the 1099C is received

How to use the strategies

Videos Included:

Laws included in letters

Why we use these strategies

Bonus Strategies to use for the removal

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This guide walks you through the step-by-step process of legally triggering a 1099C to help adjust your debt-to-income ratio. You’ll get pre-written letters, video breakdowns, and expert strategies to apply immediately.

Is this guide suitable for beginners?

Absolutely! No legal or financial expertise is required. We’ve simplified everything into a plug-and-play system that anyone can follow.

Do I need a large amount of money to start?

No. This strategy doesn’t require any major financial investments—just the right knowledge and the templates included in the guide.

How quickly can I see results?

Results can vary based on individual situations, but many users see responses within weeks after following the steps correctly.

Will this guide work for me if I’m already investing?

Yes! Traditional credit repair only focuses on removing negative marks. This method is different—it shifts how debt is viewed on your profile so you can access better financial opportunities.

What resources come with the guide?

You’ll receive:

✅ Pre-written letters to send to creditors and agencies

✅ A step-by-step guide explaining how to execute the strategy

✅ A video breakdown covering the laws that support this process

✅ Bonus strategies for additional financial leverage

How is this different from free advice I can find online?

Most online advice only scratches the surface or leaves out key details. This guide gives you the exact letters, steps, and strategies that have worked for others—no guesswork involved.

Is there a guarantee if I’m not satisfied?

Since this is a digital product, we can’t offer refunds. However, the strategies inside are proven and have helped many users get better interest rates, approvals, and financial opportunities.

4.8 / 5 based on 1,931 reviews

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.